News Release

Chamber hosting event to discuss proposed federal tax changes

TRURO – The Truro and Colchester Chamber of Commerce is actively lobbying against proposed changes to federal tax policy that have the potential for widespread repercussions to small business in Canada.

The Department of Finance Canada is considering major changes to how corporations are taxed. The proposed rules could have a significant impact on many Canadian businesses: potentially raising taxes, increasing the administrative burden on SMEs and heightening the impact on family-run businesses.

“The Truro and Colchester Chamber of Commerce is concerned about the potential impacts on business resulting from the Federal Government’s proposed tax changes,” said Chamber President Alex Stevenson. “As the ‘voice’ of more than 400 member businesses in this region, we are engaged in advocacy efforts to express our member’s concerns directly to the Federal Government.”

The Chamber has fielded a number of inquiries from concerned businesses, uncertain of the implications of the proposed changes. This Chamber joins an intensive national lobbying effort by the Canadian Chamber of Commerce representing 20,000 Canadian businesses.

Stevenson and Executive Director Sherry Martell met with Cumberland-Colchester MP Bill Casey on Aug. 29 to share concerns expressed by local businesses regarding the potential changes. The Chamber has also engaged in discussions with industry advocates who have similar concerns.

The tax changes are aimed at three areas, income sprinkling, which allows business owners to lower their tax rate by splitting income with family members in lower tax brackets; Capital gains, targeting people who claim regular business income as capital gains which are taxed at a lower rate; and passive income, limiting so-called “passive investment income” which involves removing cash from a business to invest in things such as real estate, rather than reinvesting in the company.

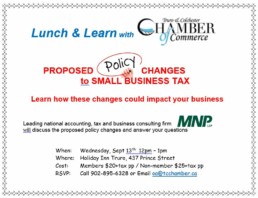

On Sept. 13 the chamber will be hosting a lunch session with Greg Mosher, senior accountant at MNP LLP, to help businesses potentially affected by the proposed changes understand the impact on their operations. This event is open to everyone, members and non-members, and will be held at the Holiday Inn, beginning at noon. Pre-registration is required. The cost is $20 for members plus HST and $25 for non-members. For more information or to reserve a seat, call 902-895-6328 or email [email protected]